|

|

|

|

|

|

| Share |

|

|

Information on this page is provided by Roseanne Jefferson.

Roseanne is a retired USPS employee with an extensive background in USPS

retirement, disability retirement, OWCP, EEO, Labor Relations and HR.

She conducts individual and group counseling and is able to

comprehensively discuss the pros and cons of employees who are on OWCP,

disability retirement and regular retirement. Roseanne will be happy

to answer your postal retirement questions. Contact Roseanne at

roseanne.jefferson@icloud.com.

|

|

|

|

Postal Retirement

Q&A July 2013 |

Good Day Postal Employees!

This column will

begin again, with a sincere thank you

for all of the prayers and concern,

expressed for my daughter. We are on a

second phase of this horrible disease

cancer, and this is not an easy

journey, at all.

This month's

column and what you see below has me

speechless!! I would like to begin

this column by actually showing you

something I felt was very disturbing,

and a brand new "feature" at this

website. See if you caught what

floored me when I read it. |

|

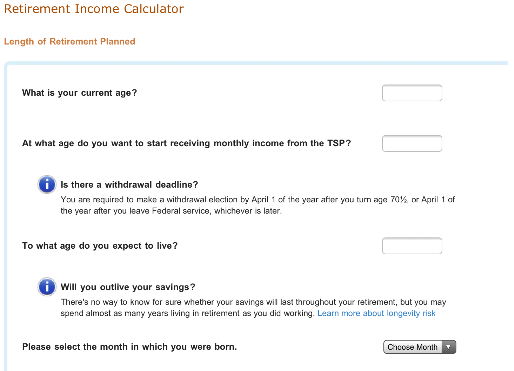

While on the phone this past weekend,

I was looking at the TSP website, to

get an overall picture of how much of

an "annuity" would be. As I had given

her the dollar figures of FERS and

Special Supplement, I proceeded to to

the TSP website, clicked on the icon I

ALWAYS DO. Something just looked

different, and to my utter shock�.. in

between the two blue i's reads "TO

WHAT AGE TO YOU EXPECT TO LIVE?" This

to me was appalling�that a government

calculator, a way to simply figure out

what one component of your retirement

money will be �asks YOU, basically,

give them an idea of when you think

you are going to die�they didn't even

ask you to ballpark it�they want just

one age�are you kidding me!! As a

federal (former) employee, this new

change to the TSP calculator will do

precisely what the change was intended

to do�frustrate you so you don't even

bother to try to figure it out.

AND you won't complain, won't let

your voices be heard on how ridiculous

and confusing this new calculator is

(if that is what you want to call it)

to determine your monthly annuity. Oh,

providing you give THEM an age you

think you will die. I guess I am

wondering if you are seeing a pattern

here. More lack of information, less

knowledgeable people to ask. Now - you

don't really have a on-site personnel

office, and the so called "tools" that

are "on-line" as they say, have made

the process of even trying to research

impossible. If I had not been going

into the TSP website for years, I

wouldn't have known just how

drastically it has changed in this ONE

AREA!!!! I would hope that this does

not go unchecked. It's a very easy way

to be BS'd about YOUR money�.Yea�.Its

YOUR MONEY!! This is not information

(TSP) that will be discussed on a

"HRSSC retirement session", nor will

Social Security, Medicare or the

Special Supplement�.because you if

don't care enough to complain, care

enough to know if your MONEY IS RIGHT,

when it comes time to retire you may

have wished you would of��just sayin'

Q 1. Good Evening Roseanne, My

husband just retired as of 5/31/2013

and we haven't heard from OPM yet, but

I have a question. Is our Life

Insurance Benefits, Dental and Medical

Insurance still in force until

premiums are taken out of our first

OPM check? Thank for your help. VT

A 1. Hi VT, Everything WILL transfer

over providing you filled out all the

paperwork, which was sent to you in

the blue retirement booklet. Your

Health Benefits AUTOMATICALLY transfer

UNLESS you do something to stop it.

Life insurance continues based upon

what you selected during the

retirement PHONE session w/HRSSC (& on

the form SF2818). That form was in

your big blue retirement booklet.

Hopefully, as tell everyone, you made

a copy of your retirement paperwork.

Check in those copies to see what you

selected for life insurance into

retirement, and congratulations on

retirement!!! Roseanne

Q 2.

Roseanne...the lady with all the

answers. I retired in January...all my

papers are in order..everything is

going smooth. I have a question about

my incentive check. The union stated

they would be deducting social

security tax on this check. Looking

over the check stub i see no deduction

for fica. I 'm confused did they make

a mistake or am I missing something?

Who can I call to find out?

A

2. Hi, The first thing would ask

is�.where is/was the check from? OPM;

Postal Srvc? I say from the Postal

Service, I would inquire with other

retirees to see if they had SS

deducted from their checks ( and I

suspect no). But you wanted the lady

with the answers�so here is my take on

this: Knowledge of the system(s) and

how they work, my 30+years in this,

and intuition tells me flat out

NOT�.they would not be taking SS out

of the incentive checks..but you

probably would like to know why I say

that. Because it's too much work to

segregate FERS and CSRS retiree''s as

only FERS employee's have Social

Security taken from their check..CSRS

employee's/retiree's didn't and don't

pay into the Social Security fund.

They are only going to do what takes

as little as "input" as possible. This

is the same reason why OPM does not

take out state taxes out for those

retiree's who live in state's that tax

federal annuities�.It's now really

YOUR responsibility. Look at it this

way, the federal government is NOT

going to set up state tax's for all 50

states.

Q 3. I sent this to

your yahoo address: Hello Roseanne, I

retired from the Postal service on

06-01-2013, as a FERS employee. On

June 6, 2013 I went and picked up my

final check, (they would not direct

deposit it). My earned annual leave

balance wasn't included on that check.

The supervisor who gave me the check

told me that it would be issued at a

later date. The retirement paperwork

that I received from Human Resources

stated that my earned annual leave

balance would be included on my final

check until some was amiss. I am

wondering what the heck the deal is.

Any experience regarding this

situation? Thank you in advance..

A 3. Hi - I wrote about this same

exact issue, let me quote from my

article in the February 2013 column of

postalmag: "There are many changes

that have taken place over the past

few months as it relates to

retirement. I am here to tell you the

truth, it may not be what you want to

hear, but it's the truth. First, the

changes that have taken place have to

do with your last paycheck and earned

annual leave when you retire. For

years, like clock work, your last pay

(or what ever few work hours you had

in the last pay period) and your

earned annual was paid to you on the

payday after you left. That last check

is a paper check, not deposited into

your checking account because there

was/is no connectivity between you and

the post office any longer after your

retirement form 50 was/is cut. That

last pay check was sent to your

employing office for you to either

pick it up, or have it mailed to you.

I call that OLD SCHOOL. The brighter

stars in the post office have decided

that since "some employees" and I do

mean "JUST some" have retired owing

the post office money, and due to

those few, they are now holding those

last pay/annual leave checks

approximately 30 days or so, to see if

you owe them 15 cents! They are still

paper checks, you still have to pick

them up, but now you need to call (I

would every Friday) to see if your

last pay check is at your employing

office for pick up. The employees that

owe money range from window clerks who

retire with "short" cash drawer, or if

you retired in July, and used all 208

hours advanced to you in the beginning

of the year (that if you retired in

July you were only eligible for 104),

or maybe were advanced leave (way too

rare but possible) and used it, and

then retired. OLD SCHOOL, in that case

they would go to OPM, so that OPM

could collect the money from the

annuity to pay back the post office,

or hold the paycheck until you pay the

discrepancy, and then the check would

be released to you. Now you have to

wait an additional 2-3 weeks to get

your last pay check. JUST delivering

the message!! I am so sure no one told

you that... but that is how it is now.

Since I can remember, this was how

last pay was handled. It gave you some

breathing room in terms of money,

waiting for the interim checks to

begin from OPM. Many of you have spent

years trying to gather sufficient

leave, so that you would have a

financial cushion when retiring,

knowing that there is a delay in the

"Interim Checks" from OPM. But at no

time, has the delay been as bad as it

is now. You have ONE office handling

thousands of retirements, and the

numbers of employees that work in

RETIREMENT at HRSSC is a very small

number, too small to tell you, without

you all flipping out! But I suppose I

don't have to tell you that... how

many of you really got that phone call

back from them, when you left your

phone number because no one answered

the phone, and required you to leave a

call back number??? No need for me to

tell you... you all tell me the horror

stories". So that is what I wrote in

February, and this information still

holds true. Roseanne

Q 4. Hi my

name is H. and my Dad has been retired

from the Post Office for many years.

He has just gone into a nursing home

and we are now applying for medicare

for him. We have been advised to have

the Post Office stop taking out fed

taxes from his pension. How do we go

about this? Is there a form we can

request? If so how do we get the form?

Also we were told to get a statement

that breaks down his pension payments,

to show whatever is taken out of it?

How would we go about getting this as

well. Thanks in advance for any help

you can provide.

A 4. I am not

sure how this would or could occur

that OPM would "suspend" or stop

taking federal taxes out of his

pension check. I will assume this

question being posed to me because

with your father, being in a nursing

home, and the application for "medicare

Part B", ( I assume) means that his

retirement check or pension is being

entirely used for his daily care, and

perhaps turned over entirely to the

nursing home�maybe? I am not familiar

enough with this to give you

guidance�I just, (from my experience)

I don't think that OPM will NOT take

any taxes out,although it is possible.

Nor do I know if or how they would

"redirect" an annuity check, say to a

nursing home. I have never dealt and

would appreciate you keeping me

updated on how this turns out. But

your first order of business is to

start with OPM. Their phone number is

1-888-767-6738. That office is in

Boyers, PA. There is also the HQ

office in DC, but start with this

phone number first. Your father has an

CSA number, that identifies him with

OPM. Not knowing how old your father

is or if he ever went "on-line" to do

any financial changes with OPM, it

probably would not do you any good to

look for his blue and white pamphlet

from OPM (which was mailed to him

after he retired with information for

just this purpose). It really contains

the same contact information I am

giving you here. Good luck, and please

let me know how this turns out. Also I

am going to assume your father was a

CSRS retiree, and just so you know,

there is a basic life insurance

"policy" that he has a retiree.

Provided he is over 65, it is free.

This is just as information in case

you did not know. Be assured, OPM has

all this information. Roseanne

Q 5. Hi Roseanne, I hope your daughter

is doing better. That illness is so

hard, feeling so helpless. A positive

attitude has helped me immeasurably.

I'm a cancer survivor since 1974 with

three serious bouts (1974, 1997, and

1999). With the right doctors and

treatment as well as support from

family and friends, I believe in

success Now for my question. I cannot

believe this can be true. A supervisor

was telling me she planned to work 15

more years to get to 43+ years. When I

asked why, she said she would get 85%

of her salary in her pension. I asked

if she was CSRS and she said no, FERS.

She said that FERS retirement changed

recently and you can get up to 85% of

your salary. I told her I knew about

the change to sick leave accrual for

50% until the end of the year and full

credit beginning 2014. I told her I

only knew about 1% per year unless you

retire at age 62 or older with 20

years, then it's 1.1%. Not that I plan

to work for 43 years, but is there any

truth to her information. Thanks again

and I wish all the best for your

daughter.

A 5. First

congratulations on being a survivor, I

see the battle almost first hand, and

can only be amazed at all of those

that have the strength it takes to

fight this fight. AS - to your

question�.As always most of what I do

is generally tell people they are

wrong (as it relates to what they

think or talk about federal

retirement); and in this too, that is

bad information. Even CSRS retirement

has a cap of 80%. You are correct 1%

and after age 62 it's calculated at

1.1%. Again there are alwaysexceptions

to the rules, as an example if a CSRS

employee had over 41 11 and then had

over 1.5 yrs of sick leave, in that

case then YES, the calculation would

be about 83% of that employee's high

3. Take care, Roseanne�������Till we

speak again��..Roseanne |

|

|

|

|

|

|

|

|