The USPS reports:

- Volume for primary source of revenue – letter mail – declines by 5.0 billion pieces

- Continued aggressive management actions along with postal reform legislation & regulatory changes critically needed to address declining volumes and changing mail mix

WASHINGTON — The U.S. Postal Service reported revenue of $69.6 billion for fiscal year 2017 (October 1, 2016 – September 30, 2017), a decrease of $1.8 billion compared to the prior year. The lower revenues were driven largely by accelerated declines in First-Class and Marketing Mail volumes.

In 2017, mail volumes declined by approximately 5.0 billion pieces, or 3.6 percent, while package volumes grew by 589 million pieces, or 11.4 percent, continuing a multi-year trend of declining mail volumes and increasing package volume. While mail volume declines for the year were somewhat offset by growth in package volume, overall volume has declined by 4.9 billion pieces.

The growth in our Shipping and Packages business provided some help to the financial picture of the Postal Service as revenue increased $2.1 billion, or 11.8 percent. However, that growth was offset in our financials by the decline in mail volumes discussed above, as well as a $1.1 billion 2016 noncash change in accounting estimate and the 2016 roll-back of the exigent surcharge mandated by the Postal Regulatory Commission which further reduced revenue by $1.1 billion from what it otherwise would have been.

“Our financial situation is serious, though solvable,” said Postmaster General and CEO Megan J. Brennan. “There is a path to profitability and long-term financial stability. We are taking actions to control costs and compete effectively for revenues in addition to legislative and regulatory reform. We continue to optimize our network, enhance our products and services, and invest to better serve the American public.”

Brennan stressed that the path forward for a financially stable future must also include urgent actions needed outside of the Postal Service’s control. They include advancement and passage of the postal reform provisions contained in H.R. 756 in the 115th Congress and the adoption by the Postal Regulatory Commission of a new pricing system as part of its 10-year pricing review, enabling the Postal Service to generate sufficient revenues to cover our costs.

Operating expenses for the year were $72.2 billion, a decrease of $4.7 billion, or 6.1 percent, compared to the prior year, although this net reduction was largely attributable to changes in actuarially determined expenses outside of management’s control. Expenses for retiree health benefits and workers compensation declined by $4.8 billion and $3.5 billion, respectively, but were partially offset by $2.4 billion in higher expenses for the amortization of unfunded retirement benefits, the result of statutory mandates effective for 2017 and changes in Office of Personnel Management actuarial assumptions. Expenses for compensation and benefits and transportation also added $667 million and $246 million, respectively, to 2017 operating expenses.

The Postal Service reported a net loss for the year of $2.7 billion, a decrease in net loss of $2.8 billion compared to 2016. Of this decline in net loss, $2.4 billion was the result of changes in interest rates, outside of management’s control, that reduced workers’ compensation expense compared to last year.

The controllable loss for the year was $814 million, a change of $1.4 billion, driven by the $775 million decline in operating revenue before the 2016 change in accounting estimate, along with the increases in compensation and benefits and transportation expenses of $667 million and $246 million, respectively.

Similar to the last several years, the Postal Service was unable to make any of the payments that were due to the federal government at the end of the fiscal year, which amounted to approximately $6.9 billion in 2017, to pre-fund pension and health benefits for postal retirees.

“Making the payments to the federal government in full or in part would have left the Postal Service with insufficient liquidity to ensure that we will be able to cover our current and anticipated operating costs, make necessary capital investments, and absorb any contingencies or changes in the marketplace,” said Chief Financial Officer and Executive Vice President Joseph Corbett. “We will continue to prioritize the maintenance of adequate liquidity to ensure the Postal Service is able to perform our primary mission of providing universal service to all Americans.”

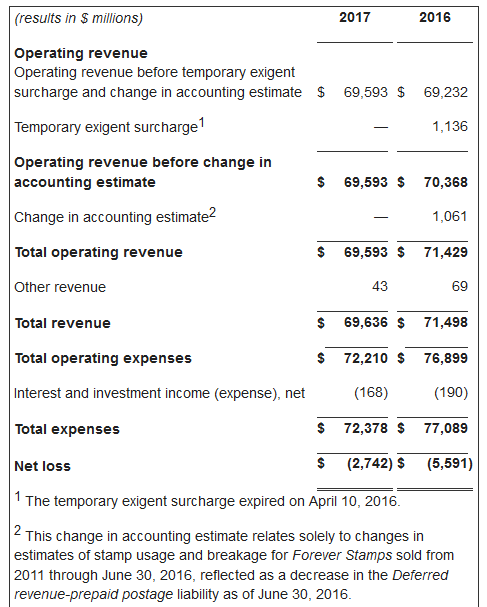

FY 2017 Operating Revenue and Volume by Service Category Compared to Prior Year

The following presents revenue and volume by service category for the year ended September 30, 2017, and 2016:

2016 Change in Accounting Estimate

2016 Change in Accounting Estimate

During the third quarter of fiscal year 2016, the Postal Service revised the estimation technique utilized to determine its Deferred revenue-prepaid postage liability for a series of postage stamps. The change resulted from new information regarding customers’ retention and usage habits of Forever Stamps, and enabled the Postal Service to update its estimate of usage and “breakage” (representing stamps that will never be used for mailing due to loss, damage or stamp collection).

As a result of this change in estimate, the Postal Service recorded a decrease in its Deferred revenue-prepaid postage liability as of June 30, 2016, which caused an increase in revenue and decrease in net loss of $1.1 billion for the year ended September 30, 2016. This change in accounting estimate resulted in a non-cash adjustment that does not impact the Postal Service’s available cash or access to cash and does not affect its controllable loss.

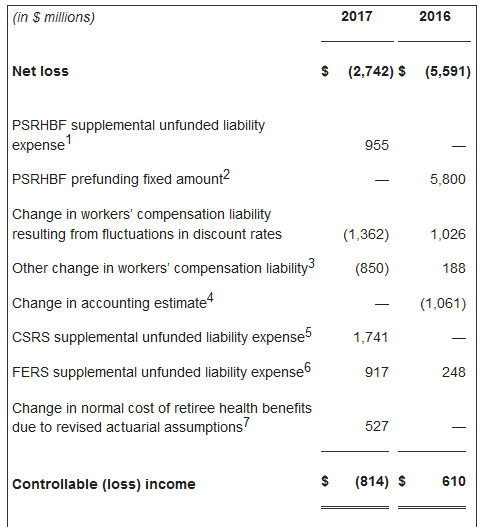

Selected FY 2017 Results of Operations

This news release references operating revenue before the change in accounting estimate and operating revenue before the temporary exigent surcharge, which are not calculated and presented in accordance with accounting principles generally accepted in the United States (GAAP).

The following table reconciles these non-GAAP operating revenue calculations with GAAP net loss for the year ended September 30, 2017, and 2016:

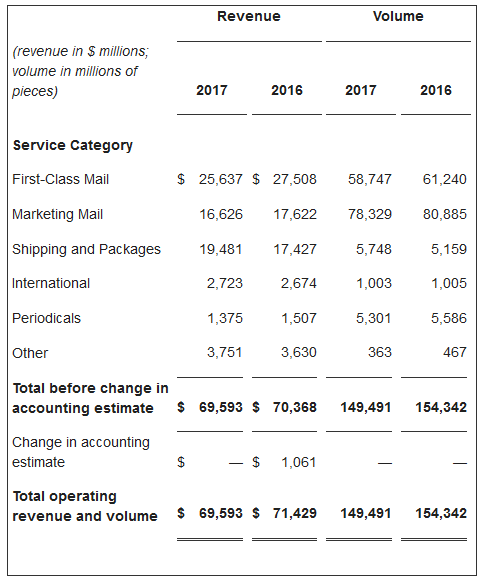

Controllable (Loss) Income

This news release references controllable (loss) income, which is not calculated and presented in accordance with GAAP. Controllable income (loss) is a non-GAAP financial measure defined as net income (loss) adjusted for items outside of management’s control and non-recurring items. These adjustments include workers’ compensation expenses caused by actuarial revaluation and discount rate changes, PSRHBF prefunding expenses, the amortization of PSRHBF, CSRS and FERS unfunded liabilities, and the change in accounting estimate.

The following table reconciles the Postal Service’s GAAP net loss to controllable (loss) income and illustrates the loss from ongoing business activities without the impact of non-controllable and non-recurring items for the years ended September 30, 2017, and 2016: