It is extremely difficult to feel financially secure if the money isn’t in your account when you need it to be, and it can be equally as difficult to make a decision when you don’t know all the facts. If you’re in a position where you’d like to experience a bit of financial freedom, you might want to consider taking out a personal loan, so that making your money last will no longer feel like a stretch. Like most of us, saving time and money is a priority but becoming knowledgeable about how a personal loan can help you should be at the top of the list as well.

Considering a Personal Loan?

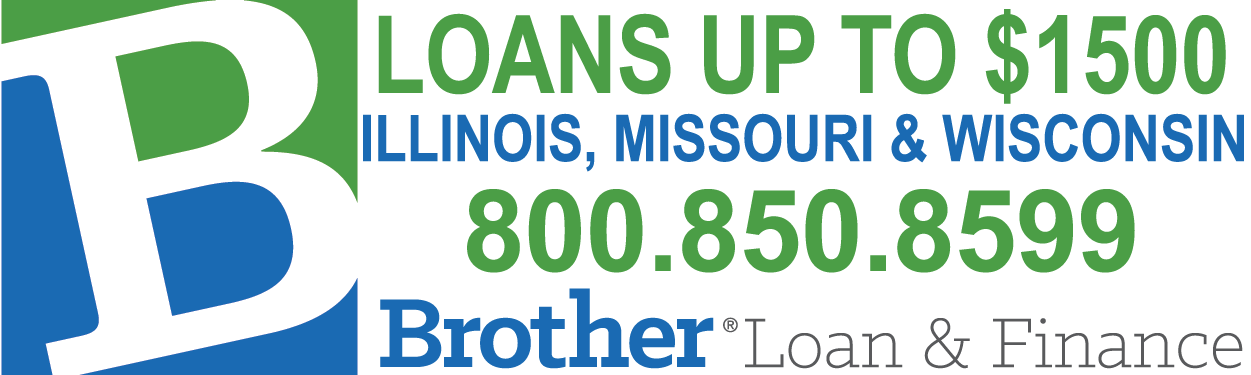

Taking out a personal loan without a plan to repay it will only serve you temporarily and put you further in debt. However, personal loans are useful under the right circumstances. At Brother Loan & Finance and our sister companies, CRF & CLS, we pride ourselves on educating you on your loan options. All our loan products have a flat APR and standard terms (often 6 months) to provide you with the very best financial flexibility. We don’t perform a credit check; your job is your credit! We know how difficult and overwhelming a financial crisis can be, but we can help.

Our loans do not include any application fees, origination fees or prepayment penalties, which further sets us apart from other lenders. To learn more about how our loan options can help you, visit our website or call us today!

Your monthly expenses don’t have to lead you into major debt. Let Brother Loan & Finance help you manage whatever financial burden you are facing with ease.

Grace Neville has devoted over 30 years to creating innovative and customer-centric lending programs, growing a single local loan store to over a dozen community locations in three states. She is passionate about teaching financial literacy to professionals and consumers.